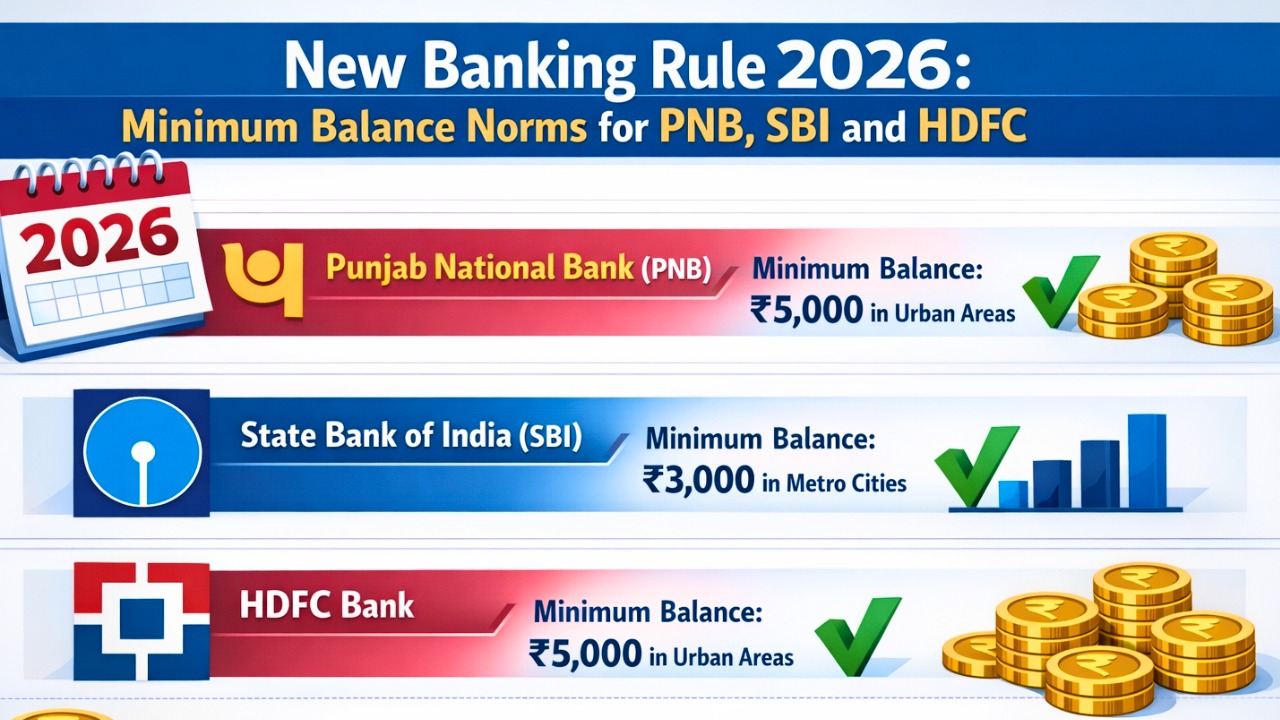

Minimum Balance Rule: In 2026, Indian banks made notable changes to how minimum balance requirements work for savings accounts. These updates affect some of the biggest names like Punjab National Bank (PNB), State Bank of India (SBI), and HDFC Bank. For account holders, this means understanding what balance to maintain, when penalties apply, and how rules have become more transparent and fair.

What Is Minimum Balance?

A minimum balance is the least amount of money you need to keep in your savings account every month or quarter. If your balance falls below this level, banks often charge a penalty fee.

In 2026, regulators nudged banks to be more transparent about these charges and to provide alerts before deducting penalties. The idea is to protect customers, especially those with irregular income or low balances, from unexpected deductions.

SBI: More Clarity, Some Relief for Customers

For many years, SBI did not require a strict minimum balance for basic savings accounts, especially for certain zero-balance account types. In 2026, SBI continued its location-based balance system for regular accounts. That means:

- In big cities, customers may have a higher minimum balance requirement

- In smaller towns and rural areas, the required balance is lower

If a customer’s balance dips below the required amount, SBI’s updated policy focuses on clear communication. Before charging a penalty, the bank must send alerts so you get a chance to restore the balance. This gives more control and reduces surprise fees for account holders.

PNB: Penalties Waived and Smoother Rules

Punjab National Bank made one of the biggest updates in 2025 that carries into 2026: penalty charges for not maintaining minimum balance have been waived for most savings accounts. This means if your balance falls short, you are less likely to see a penalty deducted.

PNB’s decision was aimed at making basic banking more accessible and customer-friendly, especially for people with irregular deposits or incomes. Account holders receive better notifications about balance levels so they can manage their funds more easily.

HDFC Bank: No Major Change in Balance Rule

Unlike some changes seen elsewhere, HDFC Bank did not change its minimum balance requirement for regular savings accounts in 2026. The bank clarified that its existing balance rules still apply:

- Regular savings accounts in metro and urban areas still require a balance

- Semi-urban and rural accounts have lower balance requirements

- Balance requirements differ by account type and branch location

However, HDFC is required to send advance notifications through SMS or mobile banking if your balance drops below the required level. This helps customers take action and avoid penalties.

Salary accounts and basic savings accounts typically remain zero-balance, meaning no fixed monthly average balance is needed for those specific account types.

How Penalty Rules Have Changed

Previously, banks could deduct penalty fees for falling below the minimum balance with little notice. In 2026, the rules became more customer-centric:

- Banks must alert customers in advance before deducting penalties

- Penalty amounts are now subject to limits so they aren’t excessively high

- Basic savings and government-linked accounts often have lower or no penalties

This change reduces the surprise factor and makes account management easier for everyone.

Who Benefits Most From These Updates

These new guidelines help certain groups more than others:

- Senior citizens and pensioners who have irregular balances

- Low-income account holders who struggle to maintain fixed amounts

- People in rural or semi-urban areas with fluctuating deposits

- Anyone who wants to avoid surprise deductions from their savings

With better alerts and defined penalty caps, managing daily finances becomes less stressful.

What You Should Do as a Customer

To avoid penalties and make the most of your savings account:

- Check your account type, many basic and salary accounts are low or zero-balance

- Keep track of notifications from your bank if your balance falls

- Use mobile or online banking to monitor your balance regularly

- Ask your bank if you qualify for a zero balance saving account instead of a regular one

These steps help you plan and avoid unnecessary charges.

Final Thought

In 2026, banks like SBI, PNB and HDFC have made minimum balance rules clearer and more customer-focused. Public sector banks such as SBI and PNB have moved toward lower penalties or waived requirements for basic accounts, while private banks like HDFC maintain their balance rules with better communication. The shift toward transparency and caps on penalty charges makes savings accounts easier to manage for most people.

If you’re a bank customer, it’s worth reviewing your account type and staying updated with your bank’s notifications so you can avoid fees and make banking work for you.